1. The Setup

The Challenge

I needed to quickly analyze the capital structure and debt maturity schedule of Tullow Oil. This meant extracting specific data from their 200-page annual report and 17-slide investor presentation:

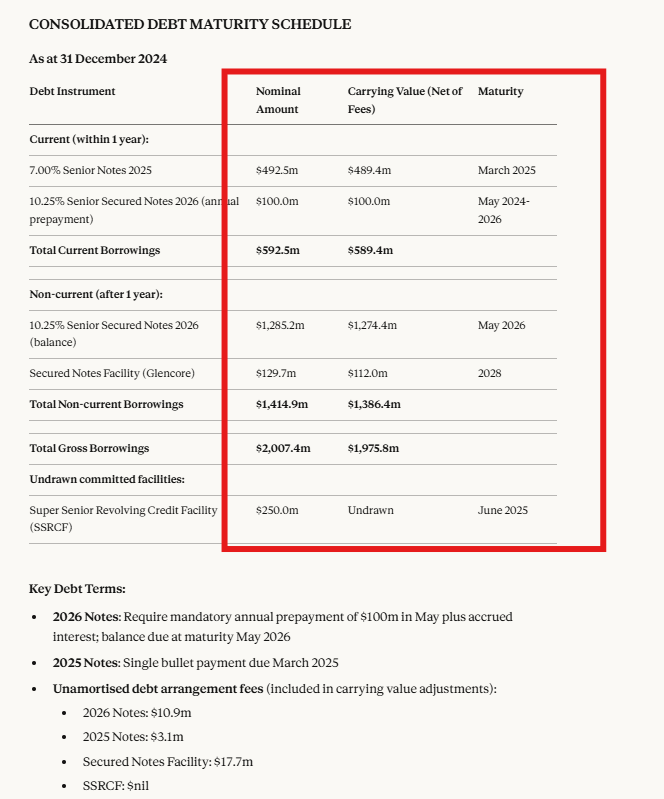

Consolidated debt maturity schedule (outstanding amounts by instrument and maturity year)

Capital structure breakdown (gross debt, net debt, equity, hybrids)

Short-term vs. long-term debt distinction

Key credit metrics and leverage ratios

Typically, this kind of debt analysis would take 30 minutes for basic extraction, and 1-2 hours if you want the depth and context that Claude and Perplexity ultimately provided.

Why AI?

AI can rapidly scan through lengthy PDFs, identify specific debt schedules across multiple footnotes, and synthesize the information with relevant context. For credit and equity analysis, speed matters-especially when you're covering multiple companies or working on time-sensitive deals.

My Background

I have about a decade of experience in investment research and have been integrating AI into my workflow since ChatGPT launched in November 2022. I'm comfortable with these tools but always verify outputs before using them in investment decisions.

2. The Experiment: Testing 4 AI Tools

Tools Tested

I ran the exact same prompt across four leading AI platforms:

Gemini 3 Pro

Claude 4.5 Sonnet (Extended Thinking)

ChatGPT 5.2 (Extended Thinking)

Perplexity Pro (Deep Research)

The Prompt

I used a straightforward prompt crafted with basic ChatGPT assistance. Here's what I fed to all four tools:

You are acting as a credit and equity research analyst reviewing an annual report.

Extract the consolidated debt maturity schedule, including outstanding amounts by instrument and maturity year.

Identify and summarize the capital structure at the consolidated level (gross debt, net debt, equity, hybrids if any).

Use only reported figures and footnotes from the annual report, clearly distinguishing short-term vs long-term debt.

If maturities or instruments are not fully disclosed, state the gap explicitly without estimating or inferring.Data Inputs

Tullow Oil 2024 Annual Report (200 pages)

Tullow Oil Investor Presentation (17 slides)

3. The Outcomes: A Comparative Breakdown

Speed

ChatGPT, Gemini, Claude: ~3 minutes each

Perplexity: ~6 minutes (longer processing time)

Compare this to:

Manual extraction: 30 minutes (basic)

Manual analysis with context: 1-2 hours

Accuracy

Numbers were almost 100% accurate across all platforms. This was the most impressive finding-each tool correctly extracted the debt figures from the annual report.

Quality & Depth: The Real Differentiators

Winner #1: Perplexity (The Surprise)

The output quality was surprisingly excellent, structured like a professional research report and extending well beyond the prompt by calculating leverage ratios that included lease liabilities. It proactively provided additional insights, such as pro forma leverage reflecting debt drawn after the reporting date and covenants (check screenshot in Figure 1 and Figure 2 or chat link below) . While it cited footnote names without page numbers, the depth and initiative meaningfully shifted my perception of Perplexity from being primarily a news or current-events tool.

Figure 1

Figure 2

Winner #2: Claude 4.5 Sonnet

The output was extremely polished from an investment analysis perspective, incorporating all relevant and related disclosures in a well-structured format. While longer than outputs from Gemini or GPT, every detail remained relevant and value-adding. It also included some source references, and overall the work was client-ready-I would be comfortable sharing Claude’s output directly with clients after a high-level verification of key numbers. It still missed out few things like Proforma analysis which Perplexity did.

Figure 3: Claude gave decent output with both Nominal and carrying value. I think this add value as sometime there is a lot of difference between carrying value and nominal value which create confusion and takes time reconciling the difference.

Strong Performance: Gemini 3 Pro

The output quality was good and sufficient to address the core question, with a clear and readable structure. However, it was less polished than Claude and Perplexity and did not provide the same depth of contextual insight. Additionally, it lacked clear page numbers or explicit source attribution.

Needs Improvement: ChatGPT 5.2

The numbers were accurate, but the structure was weak from an investment analysis perspective-hard to read and not formatted for professional use. It also provided no clear page numbers or source attribution.

What None of Them Caught

Lease liabilities maturity schedule: None of the tools automatically included this as part of debt. This is a fair interpretation (leases can be excluded from traditional "debt" definitions), but it's something I'd ask for in a follow-up prompt if needed.

4. What I Learned

Key Insight #1: Be Clear About What You Want

Looking back, my prompt was somewhat loose. Perplexity and Claude gave me far more detail than I asked for, while Gemini gave me exactly what I requested-nothing more, nothing less. ChatGPT answered the question but poorly formatted.

Lesson: If you have a specific, narrow requirement, Gemini or ChatGPT might suffice (though you'll need to clean up ChatGPT's output). If you want comprehensive analysis with context, go with Claude or Perplexity.

Key Insight #2: AI Reading Accuracy is Impressive

All four tools accurately extracted complex financial data from a 200-page PDF. My confidence in AI's ability to parse long documents continues to increase, though I still verify the numbers-at least for now.

Key Insight #3: Source Attribution Matters (But Needs Work)

Claude & Perplexity: Provided some sources (footnote references)

Gemini & ChatGPT: No source attribution

Next time: I'll explicitly ask for page numbers in my prompt. As my confidence grows, I may reduce this verification step, but for now it's still essential.

When to Use Which Tool

Use Claude when:

You need polished, client-ready output where context and related disclosures are properly considered, and you’re comfortable with slightly longer responses as long as all relevant information is fully covered.

Use Perplexity when:

You want proactive insights that go beyond the initial prompt, value report-style formatting, and rely on a second opinion after Claude, since different tools often surface different issues or perspectives.

Use Gemini when:

You have a very specific, narrow question, want a concise answer without extra context, and you’re working quickly - so you just need the core numbers.

Use ChatGPT when:

...honestly, I'd use one of the above for financial analysis. ChatGPT's structuring needs work for investment research use cases.

5. How to Replicate This

The Workflow

Gather your documents: Annual report, investor presentations, debt footnotes

Draft a clear prompt: Be explicit about what you want (instruments, maturities, ratios, etc.)

Run it through your preferred tool(s): Based on my test, start with Claude or Perplexity

Review the output: Check structure, completeness, and relevance

Verify key numbers: Spot-check the debt figures against the source document

Customize for your analysis: Add your own insights, adjust formatting

6. Trust & Verify

My Verification Process

After getting outputs from all four tools, I spent 10-15 minutes on verification:

Checked debt breakdown: Confirmed the split between different instruments matched the annual report

Validated maturity schedule: Spot-checked the maturity years against footnotes

Quick reconciliation: Made sure gross debt, net debt, and equity figures tied to the balance sheet

This verification step is critical-especially for companies with complicated debt structures.

When I'd Do More Thorough Review

For companies with very complex debt structures (multiple subsidiaries, cross-guarantees, hybrid instruments, convertible debt), I would:

Still use AI as the starting point

Spend more time on verification

Consider improving my prompt to handle the complexity better

The AI dramatically speeds up the extraction phase, but human judgment remains essential for interpreting complex capital structures.

My Current Confidence Level

Confidence varies by tool: Claude is client-ready after light verification; Perplexity and Gemini are better as internal inputs requiring synthesis and validation; ChatGPT is least suitable for direct sharing due to formatting issues despite accurate numbers.

The Bottom Line

AI doesn't replace the analyst-it accelerates the grunt work. You still need domain knowledge to:

Craft effective prompts

Spot gaps or inconsistencies in the output

Interpret complex structures

Add strategic insights beyond the numbers

But for routine debt analysis on relatively straightforward companies, AI can compress hours of work into minutes.

Final Thought

If you're doing credit or equity analysis, I'd recommend running your task through both Claude and Perplexity and comparing outputs. You'll often get complementary insights, and the 6-9 minute investment is well worth it compared to manual analysis.

Links to all outputs from this experiment:

Next post: I'll dive into another financial analysis workflow using AI. Stay tuned.