I had a straightforward but time-consuming task: update my Rockwell Automation financial model with Q2 2024 data from their 10-Q. Nothing fancy - just pulling fresh numbers and extending formulas in one tab. Normally, this takes about 30 minutes of careful work.

I decided to test whether AI could handle it. The result? Done in 5 minutes, with another 5 for QA.

The Setup

The Task: Update Q2 2024 data in my existing Excel financial model for Rockwell Automation. Specifically, I needed to:

Populate column W on the "Fin Summary" tab (~200 rows)

Pull exact figures from the Q2 10-Q

Apply existing formulas where appropriate

Maintain consistency with how prior periods were structured

Why AI: Even simple model updates require attention to detail - matching line items, deciding which cells need formulas vs. hard inputs, ensuring cash flow follows the right logic (quarterly vs. cumulative). It's not difficult work, but it's tedious and prone to copy-paste errors. If AI could handle this reliably, that's real time savings.

My Background: I'm an intermediate to advanced AI user for investment research, so I know how to prompt effectively. But I wanted to see if this could work with a reasonable prompt that other analysts could replicate.

The AI Workflow

Tool Used: Claude Opus 4.5

I tested this across multiple tools (Claude Sonnet 4.5, GPT, Perplexity), but only Opus 4.5 delivered usable results. The others failed to update the model correctly, so I'm focusing on what actually worked.

The Prompt:

I spent a couple of attempts refining this across different tools before landing on this version:

Act as an experienced financial analyst updating an existing Excel financial model. Use the uploaded PDF to update Q2 2024 data in column W on the "Fin Summary" tab only. Pull exact reported figures and apply existing formulas where applicable, referring to the previous period column to determine which rows require formulas versus direct inputs. For the Cash Flow Statement, determine whether the column should reflect quarterly or cumulative values by comparing against prior periods, and update consistently. Do not modify model structure or other columns, only populate values or extend formulas in the specified column. If any value or treatment cannot be determined with high confidence, leave it blank and clearly flag it.

The Process:

Uploaded two files: Rockwell's Q2 2024 10-Q (PDF) and my Excel model (9 tabs total)

Ran the prompt specifying only the "Fin Summary" tab for update

Downloaded the updated model

Ran QA checks

Time Invested:

Prompt refinement: ~5 minutes (across different tools)

Opus 4.5 execution: ~5 minutes

QA review: ~5 minutes

Total: ~15 minutes vs. 30 minutes manually

What Actually Worked

Near-Perfect Accuracy:

Claude Opus 4.5 updated the model with close to 100% accuracy. It:

Pulled the correct reported figures from the 10-Q

Applied formulas where the prior period had formulas

Hard-coded values where the prior period had hard-coded values

Maintained the quarterly vs. cumulative logic in the cash flow section by referencing prior periods

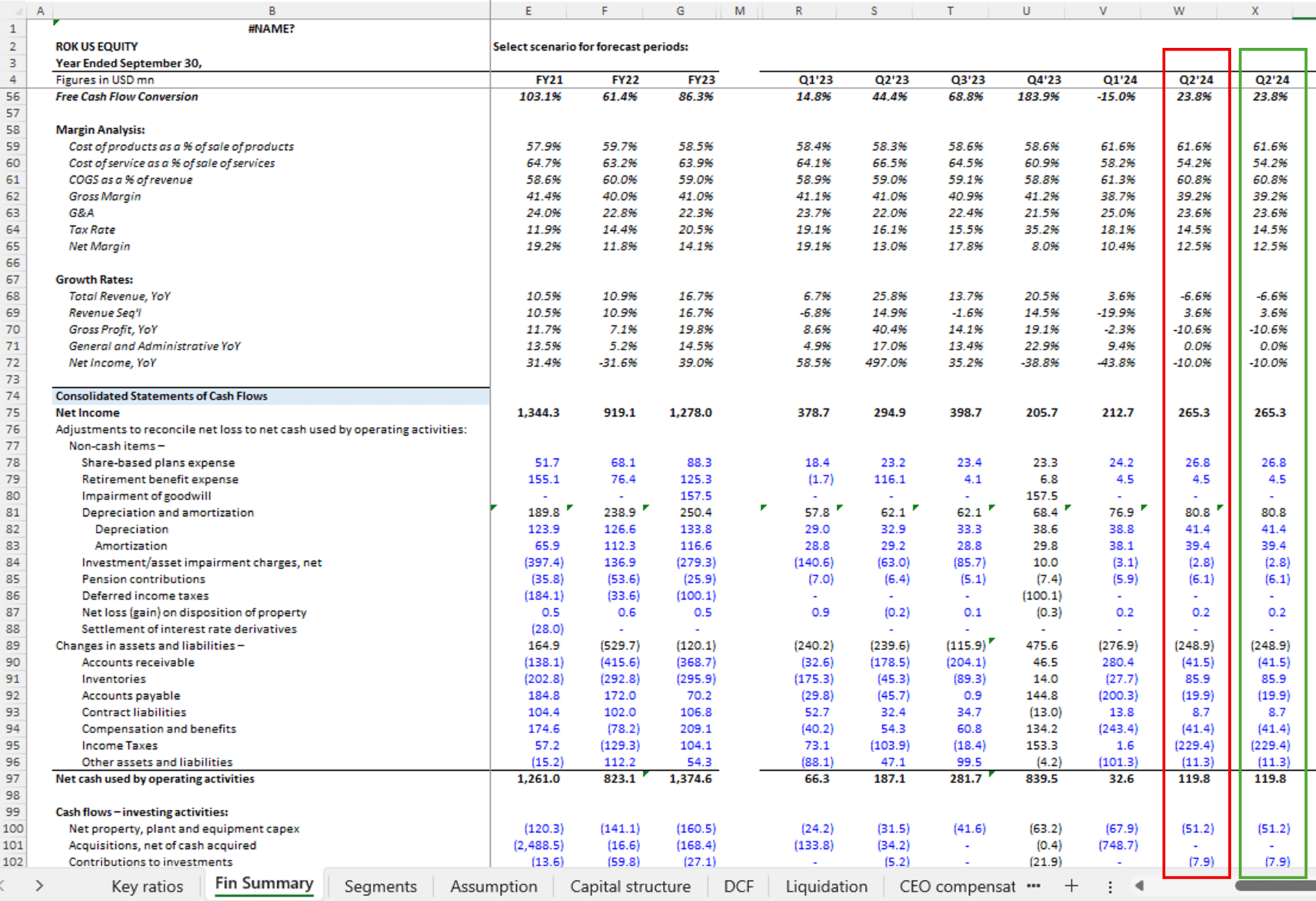

Q2 numbers in Red box are updated by AI while Q2 2024 number in Green box were updated manually

Figure 1

Figure 2

Figure 3

In the Figure 1 , 2 & 3 above the numbers in red box were updated by AI (Claude Opus) and number in Green box were updated manually to check for accuracy.

Why It Worked:

My model structure played a big role here. A few key factors:

Detailed but simple: The model had ~200 rows but straightforward logic

Matched reporting: Line items in my model aligned with how Rockwell reports in their financials

Clean structure: Each period in its own column, consistent formula patterns

The prompt explicitly told the tool to "refer to the previous period column" to determine treatment, and Opus followed this instruction perfectly.

What Didn't Work (With Other Tools)

Claude Sonnet 4.5, GPT, and Perplexity:

Simply put, they didn't update the model correctly. I didn't dig deeper into the specific failures since Opus worked, but these tools either mismatched line items, broke formulas, or didn't follow the cash flow logic properly.

Bottom line: For this specific task, Opus 4.5 was the only tool that delivered.

Key Learnings

When This Works:

This approach is ideal for:

Simple, well-structured models where line items match reporting

Quarterly updates with consistent structure period-over-period

Models with clear formula patterns that can be inferred from prior periods

When to Be Careful:

Trickier models: If your model has complex logic, linked tabs, or non-standard layouts, updating in one go becomes harder. You'll need more advanced prompting or multiple passes.

Reporting changes: If the company changed how they report certain line items quarter-over-quarter, AI won't catch this without explicit instructions.

Multiple tabs: Don't try to update multiple tabs at once. Focus on one tab or a limited number of rows at a time for better control.

Critical Requirements:

QA needs an experienced analyst. Period. Even with 100% accuracy on this run, I still needed to verify formulas, spot-check calculations, and ensure nothing broke. This takes knowledge of both the model and the company's financials.

Practical Takeaways

Replicable Workflow:

If your model is similar to mine (detailed but simple, matches reporting structure), you can use this exact approach:

Upload both files: The quarterly filing (10-Q/10-K) and your Excel model

Specify the exact scope: Which tab, which column, which rows if needed

Reference prior periods: Tell the tool to look at the previous period column to determine formula vs. input treatment

Add a safety net: Include "If any value cannot be determined with high confidence, leave it blank and clearly flag it"

Run QA: Check formulas, verify key line items against the filing, ensure nothing broke

Tool Recommendation:

Based on this test, Claude Opus 4.5 is the tool for financial model updates. The other options I tried didn't deliver reliable results.

Customization Tips:

If your model structure is different:

Specify formula logic explicitly: If certain rows always have formulas (e.g., margins, growth rates), state this in the prompt

Break it into smaller chunks: Update 50-100 rows at a time if the full tab is too complex

Include context on reporting quirks: If cash flow uses cumulative figures but income statement uses quarterly, spell this out

The Validation Process

Here's my non-negotiable QA checklist:

Step 1: Spot Check Key Figures

Revenue, operating income, net income - do they match the 10-Q exactly?

Cash flow from operations - quarterly or cumulative, and is it correct?

Step 2: Formula Integrity

Pick 5-10 calculated rows (margins, per-share metrics, growth rates)

Verify formulas still reference the right cells

Check for any accidental hard-coding

Step 3: Structure Validation

Did any rows shift or get deleted?

Are column widths/formatting intact?

Does the model still flow logically?

Time Required: About 5 minutes for a ~200-row tab update. An experienced analyst who knows the model can move quickly.

Confidence Level:

I'm comfortable using this output as long as:

There are no major reporting changes quarter-over-quarter

The number of line items remains the same

The model structure I uploaded was already sound

If any of those conditions change, I'd be more cautious and potentially revert to manual updates for that period.

Bottom Line:

For straightforward quarterly model updates, AI (specifically Claude Opus 4.5) can cut your time in half while maintaining high accuracy. But this isn't "set it and forget it" - QA remains a critical part of the workflow. An experienced analyst using this tool just became 2x more efficient at the tedious parts of their job. That's the real value here.

Next post: I'll dive into another financial analysis workflow using AI. Stay tuned.